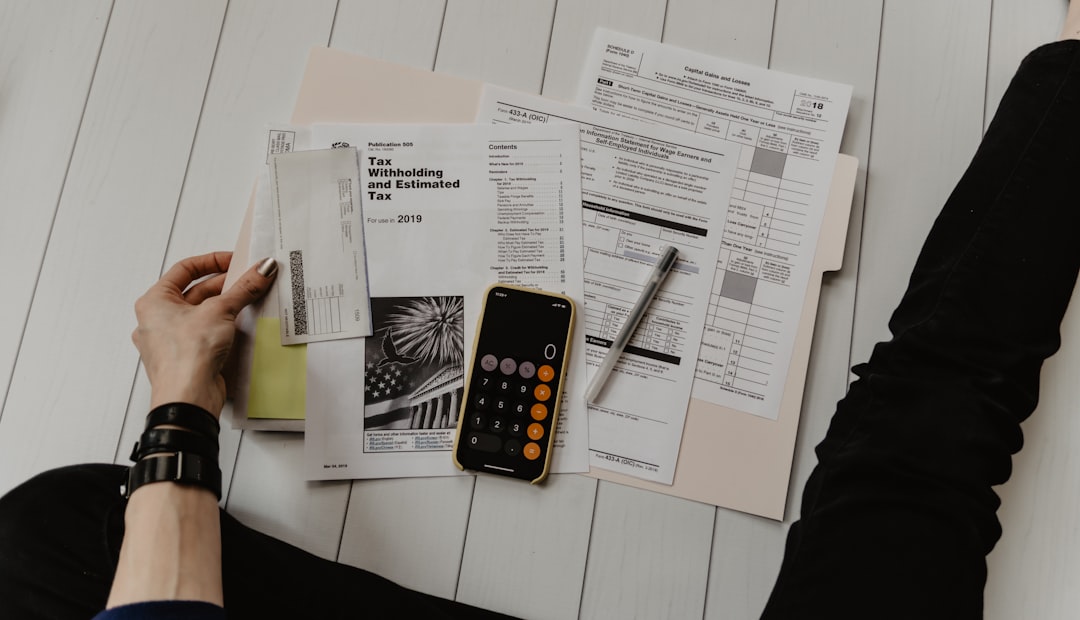

Essential Budget Planning Strategies for 2026

Discover the most effective budgeting methods that will transform your financial situation this year.

Read MoreExpert guidance on personal finance, budgeting, and expense control to build your financial freedom

Explore Financial Tips

Create realistic budgets that align with your goals and lifestyle without sacrificing what matters most to you.

Monitor your spending patterns and identify areas where you can save more effectively every month.

Set achievable financial milestones and receive practical strategies to reach them faster than expected.

Discover proven techniques to grow your savings and build an emergency fund for unexpected situations.

Discover the most effective budgeting methods that will transform your financial situation this year.

Read More

Learn practical techniques to reduce unnecessary spending without feeling deprived or restricted.

Read More

Step-by-step guidance to create a safety net that protects you from financial emergencies.

Read MoreAll our financial recommendations are backed by thorough research and proven methodologies from financial experts.

We focus on actionable strategies you can implement immediately to see real results in your finances.

Stay informed with regularly updated content reflecting the latest trends and best practices in personal finance.

Financial experts recommend saving at least 20% of your income, but start with what you can manage and gradually increase.

This rule suggests allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment.

Use budgeting apps, spreadsheets, or even a simple notebook to record all your expenses daily for better awareness.

Start investing once you have an emergency fund covering 3-6 months of expenses and have paid off high-interest debt.